Sign Up With Wyoming Federal Credit Union: Secure and Member-Focused Banking

Sign Up With Wyoming Federal Credit Union: Secure and Member-Focused Banking

Blog Article

Unlock Exclusive Perks With a Federal Lending Institution

Federal Cooperative credit union offer a host of special advantages that can considerably influence your financial wellness. From boosted cost savings and examining accounts to lower passion rates on finances and personalized monetary planning services, the advantages are tailored to help you save money and attain your economic objectives more effectively. There's more to these advantages than simply financial perks; they can likewise give a feeling of safety and security and neighborhood that goes beyond typical financial solutions. As we check out even more, you'll uncover exactly how these unique advantages can absolutely make a difference in your monetary journey.

Membership Qualification Requirements

To become a member of a government cooperative credit union, people should satisfy specific qualification requirements established by the institution. These requirements vary depending upon the specific cooperative credit union, yet they typically include variables such as geographical place, work in a certain market or company, membership in a particular organization or association, or family relationships to current members. Federal lending institution are member-owned economic cooperatives, so eligibility requirements are in location to make certain that people that join share a common bond or organization.

Improved Financial Savings and Examining Accounts

With improved financial savings and inspecting accounts, federal credit report unions offer participants superior monetary items developed to maximize their cash monitoring methods. Additionally, government credit history unions usually provide online and mobile financial services that make it hassle-free for participants to check their accounts, transfer funds, and pay costs anytime, anywhere. By utilizing these improved financial savings and checking accounts, members can maximize their cost savings potential and effectively manage their daily funds.

Lower Rate Of Interest on Car Loans

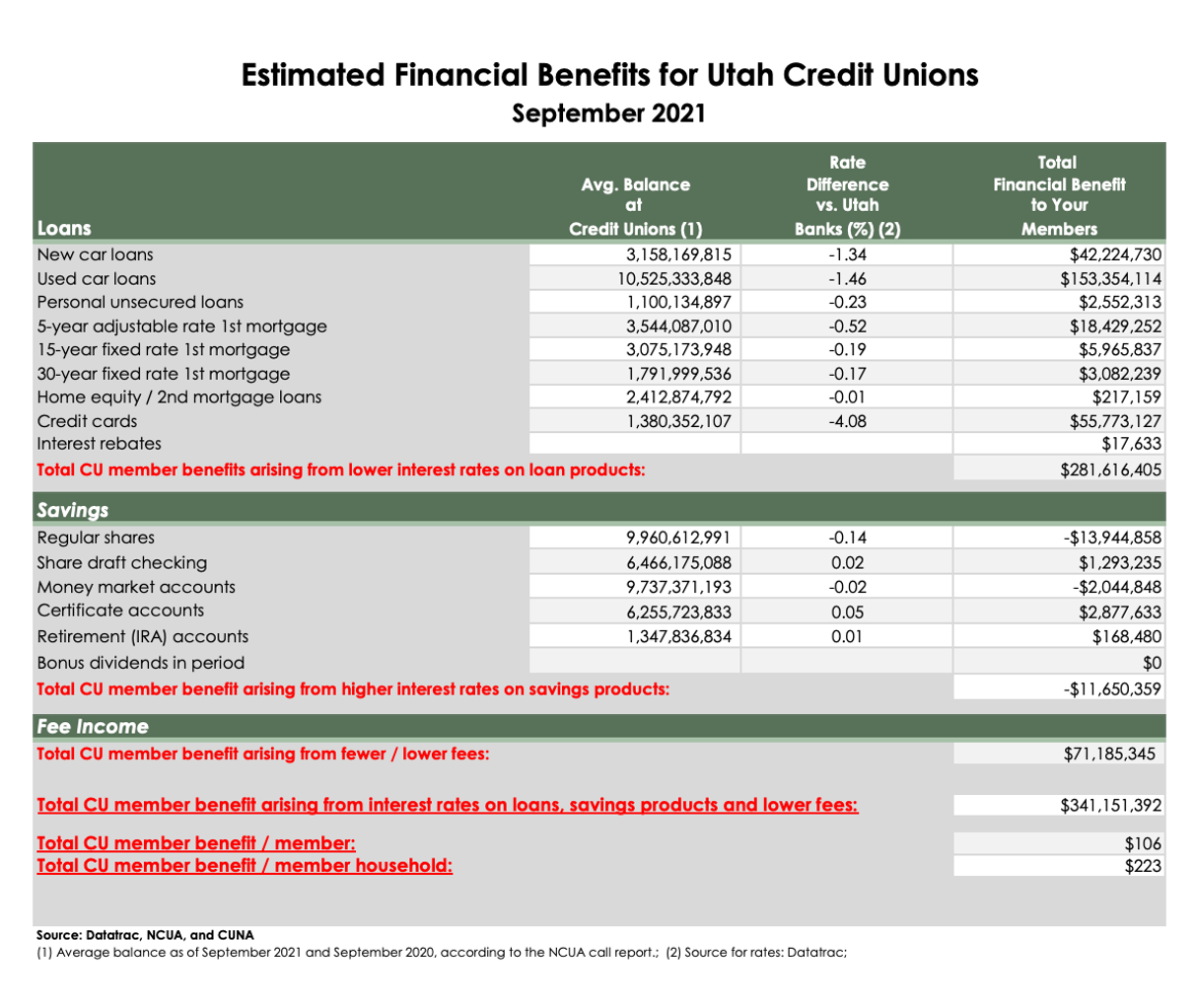

Federal credit report unions provide participants with the advantage of lower interest prices on fundings, allowing them to obtain cash at even more budget friendly terms contrasted to other financial institutions. Whether participants require a funding for a cars and truck, home, or individual expenditures, accessing funds with a federal credit rating union can lead to extra beneficial settlement terms.

Personalized Financial Planning Services

Provided the concentrate on improving members' economic health via lower rates of interest on car loans, government lending institution also supply customized financial preparation services to aid people in accomplishing their have a peek at this website long-lasting monetary objectives. These personalized solutions satisfy participants' specific requirements and situations, providing a tailored strategy to economic planning. By assessing earnings, costs, liabilities, and possessions, government lending institution monetary planners can aid members develop a comprehensive monetary roadmap. This roadmap may include methods for saving, investing, retirement planning, and financial debt management.

Furthermore, the tailored monetary preparation solutions offered by federal lending institution often come at a lower cost contrasted to exclusive financial experts, making them much more available to a wider array of people. Members can benefit from expert assistance and knowledge without sustaining high charges, straightening with the cooperative credit union ideology find out of prioritizing participants' economic wellness. Generally, these solutions objective to equip participants to make informed economic choices, build wealth, and secure their monetary futures.

Access to Exclusive Participant Discounts

Participants of government lending institution enjoy unique accessibility to a series of member price cuts on numerous product or services. Wyoming Federal Credit Union. These price cuts are a beneficial perk that can aid members save money on special acquisitions and everyday expenditures. Federal cooperative credit union typically partner with merchants, find out here now company, and various other businesses to supply discount rates exclusively to their participants

Participants can gain from price cuts on a selection of products, consisting of electronic devices, clothes, travel plans, and extra. Additionally, solutions such as cars and truck rentals, resort bookings, and amusement tickets may likewise be readily available at reduced prices for lending institution participants. These unique price cuts can make a considerable difference in members' budgets, allowing them to delight in financial savings on both vital products and luxuries.

Verdict

In final thought, joining a Federal Lending institution provides numerous advantages, consisting of enhanced savings and inspecting accounts, lower rate of interest on finances, customized financial planning services, and accessibility to special member price cuts. By becoming a member, individuals can take advantage of a variety of economic perks and services that can aid them save money, prepare for the future, and reinforce their connections to the local area.

Report this page